In a competitive media environment where viewer preferences shape the success of television stations, One TV has once again emerged as the frontrunner among Malta’s private channels. A comprehensive survey conducted among subscribers of major telecom providers GO, Melita, and Epic underscores One TV’s commanding lead in viewership for 2025. Drawing from a robust sample of 196,628 subscribers, the results highlight One TV’s ability to captivate audiences with engaging content, solidifying its position as the most preferred private station for yet another year.

Survey Methodology

The survey was meticulously designed to capture accurate viewership data across Malta’s paid television landscape. It encompassed 196,628 subscribers from the country’s primary telecommunications providers: GO, Melita, and Epic. Data collection occurred over the full calendar year of 2025, employing a consistent methodology applied daily through uniform technological devices. This approach likely leverages set-top box metrics or similar real-time tracking systems, ensuring objectivity by measuring actual viewing behavior rather than relying on self-reported preferences or recall-based questionnaires. The uniformity in methodology and technology eliminates variability, providing credible, like with like comparisons across channels and time periods. Such continuous monitoring offers a granular view of audience engagement, reflecting genuine preferences in a dynamic media market.

Unrivaled Leadership Among Private Channels

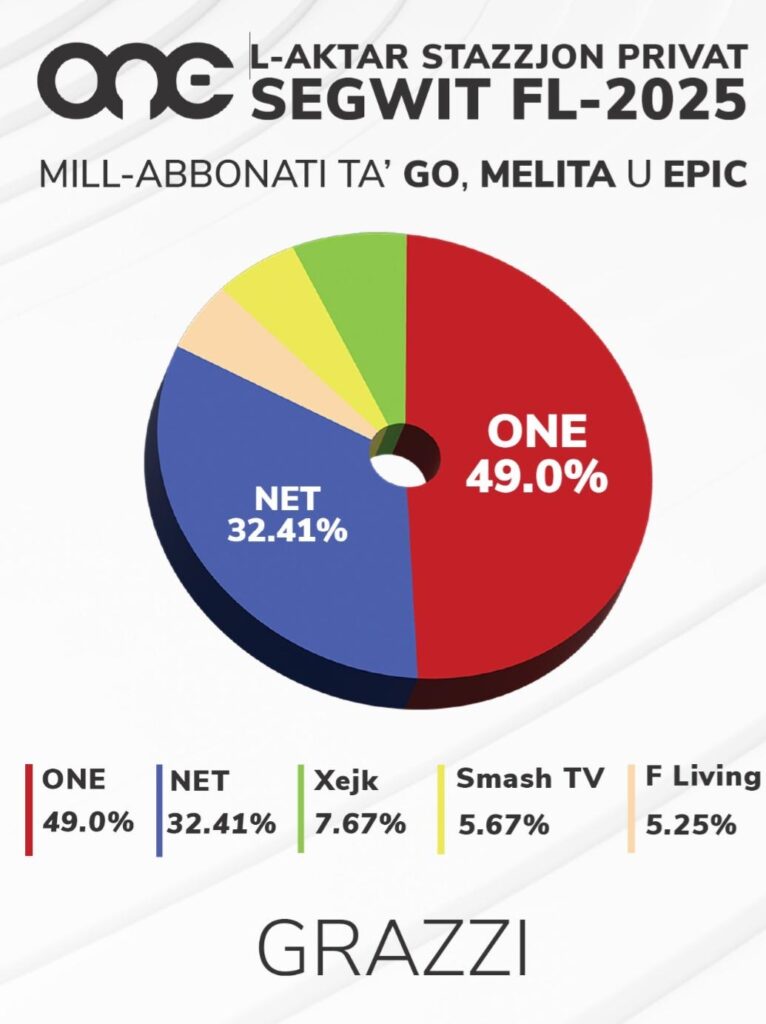

The survey data reveals a clear hierarchy in viewer engagement across Malta’s private television landscape. One TV captured an impressive 49% share of viewership, far outpacing its competitors. This dominance is evident when compared to other key players:

- NET TV: 32.41%

- XEJK: 7.67%

- SMASH: 5.67%

- F LIVING: 5.25%

These figures, derived from consistent daily tracking using the same methodology and technological devices, demonstrate One TV’s broad appeal. With nearly half of all private channel viewership directed toward One TV, the station’s programming—ranging from news, entertainment, and local interest segments—resonates strongly with Maltese audiences. This success is not fleeting; it reflects a sustained strategy that prioritizes quality and relevance in a fragmented media market.

Silvio Scerri

Commenting on these results, Mr. Silvio Scerri, Chairman of the Board of Directors of ONE, stated: “I had no doubt that the actual audience figures for ONE are significantly strong. Among the private stations, it remains the most widely followed. This success is, in my view, largely attributable to the consistent investment in high-quality Maltese productions that ONE continues to prioritise and promote.”

Head-to-Head Comparison: One TV vs. NET TV

When isolating the competition between the two leading private stations, One TV’s superiority becomes even more pronounced. Over the full year of 2025, One TV commanded 60.2% of the combined viewership between itself and NET TV, while NET TV trailed with 39.8%. This stark contrast—where One TV attracts more than 1.5 times the audience of its closest rival—further validates the survey’s credibility. Based on the same subscriber base of 196,628, these results eliminate variables and provide a direct apples-to-apples comparison.

Such metrics are particularly significant in an industry where audience share directly influences advertising revenue and market influence. Industry estimates suggest that each percentage point of viewership can equate to approximately €1 million in potential value, amplifying the economic implications of One TV’s lead.

Context Within the Broader Broadcasting Ecosystem

Even when expanding the analysis to include the public broadcaster PBS, One TV’s performance remains remarkably competitive. The survey indicates that the gap between PBS and One TV narrows to just 9% over the full year, a testament to One TV’s growing stature. This close contest challenges the traditional dominance of public broadcasting and signals a shift toward private channels that offer dynamic, viewer-centric content.

By focusing on subscribers from GO, Melita, and Epic, who represent the vast majority of Malta’s paid TV audience, the survey ensures a representative cross-section of the viewing public. The advanced tracking methods employed minimize biases and deliver actionable insights for broadcasters.

One TV’s triumph in the 2025 survey is a clear indicator of its strategic prowess and audience loyalty. With a 49% share among private channels and a decisive edge over NET TV, the station continues to set the benchmark for excellence in Maltese television. As the media landscape evolves, One TV’s ability to maintain this momentum will be key to its ongoing success. These results not only celebrate past achievements but also pave the way for future innovations in content delivery, ensuring One TV remains a staple in Maltese households.