1.In exercising right of reply Ivan Bartolo stated that NG Blog Posts omitted parts of the ToM Article which are crucial to a fair and complete and understanding of the matter in question.

According to Ivan J. Bartolo the omitted extracts which he then goes to quote, add context and provide readers a better and more accurate understanding of the matter. In this regard he quotes statements provided by the Andrew Riley (CEO of IDOX Health (the entity which in 2017 acquired the shares from IB and his co-shareholders) to the ToM in an attempt to minimize the issue.

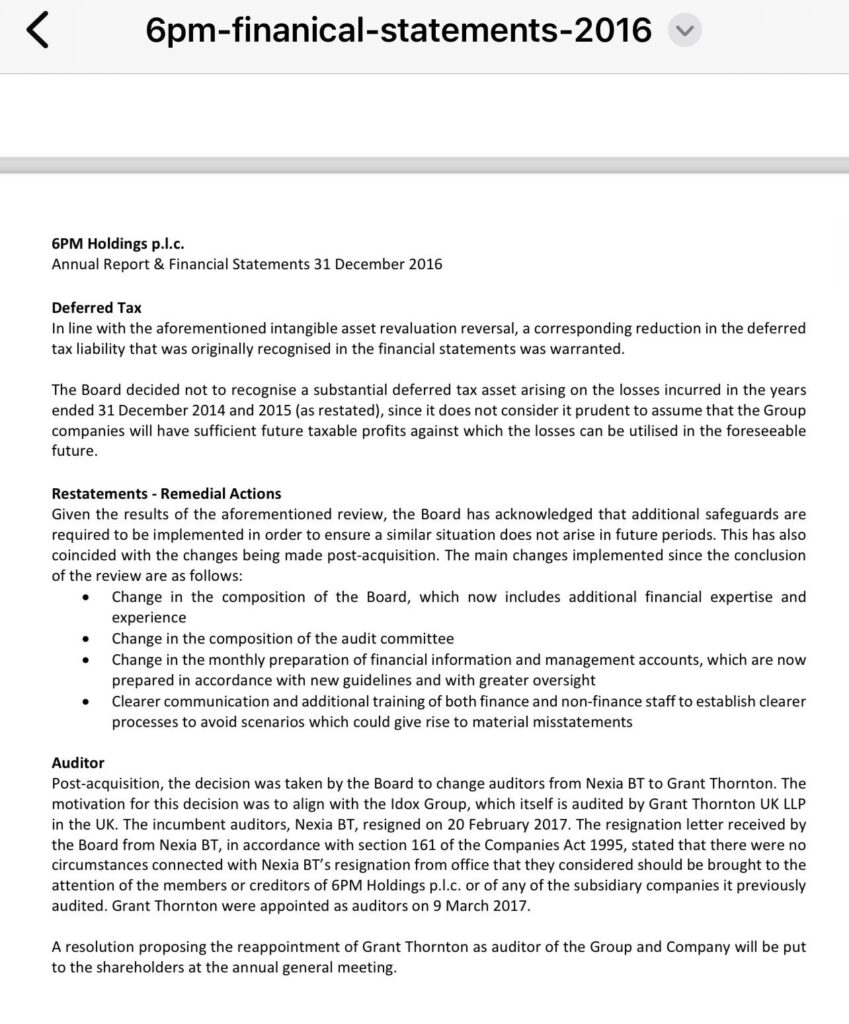

2. Rather than quoting from the ToM article and to fend off accusations I would suggest to Ivan Bartolo so as to give a faired picture of the situation to the readers to refer to the Annual Report and Financial Statements of 6 pm Holding plc for the year 2016, where the material misstatements in the financial statement for years ending December 2014 and 31 December 2015, were reported. In this regard specific reference is made to pages 5 to 9 of the Financial Statements.

https://nevillegafa.com/wp-content/uploads/2024/10/6pm-finanical-statements-2016.pdf

3. Page 5 – 7 Restatements – This sections analysis in detail the reasons leading to the need of restating the financial information disclosed in the 2014 and 2015 financial statements.

During its review the new board of directors sought further expert advice from an external specialist and concluded that *’the original accounting treatment was inappropriate and, as such, required to be restated’*.

What does this mean in practice? The financial results presented by Ivan Bartolo for 2014 and 2015 showed a profit of 800k in 2014 when in fact this should have been a loss of 200k and the profit of 2015 of 1.7m being was actually to a loss of 4.8m! INCREDIBLE!!

This lead to the resignation of the former board as well as the audit committee!

It would be interesting if Onor. Ivan J. Bartolo explains to my readers if he profited financially from these Misstated Accounts when the company was sold.

Would the acquiring company bought the shares in 6pm based on the misstated financial statement of 2014 and 2015 which showed a profit when in truth the company made yet more losses?

Now let us discuss the Legal and Regulatory Consequences of Misstated Accounts – What are the consequences ?

Accounting Fraud – This includes overstating profits and assets. This could have the effect of misleading the general public, shareholders, prospective investors, financial markets (in case of listed companies), creditors etc.

Financial Statements must give a true and fair view of the undertaking’s assets, liabilities, financial position and profit or loss of a company. It is the directors’ obligations to ensure this.

Failure on part of the directors to act honestly has consequences of a civil, regulatory and criminal nature.

Listed companies, like 6pm, must also abide by listing rules and fall under the supervision of the MFSA as listing authority as well as the Malta Stock Exchange.

Have the MFSA as well as the Police investigated this case? What measures have been taken?